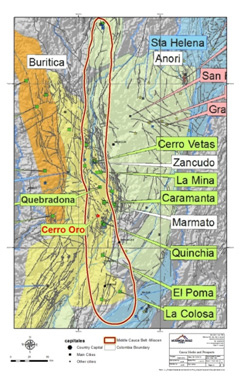

Cerro Oro, within the department of Caldas, Colombia

Nature of interest and terms of acquisition

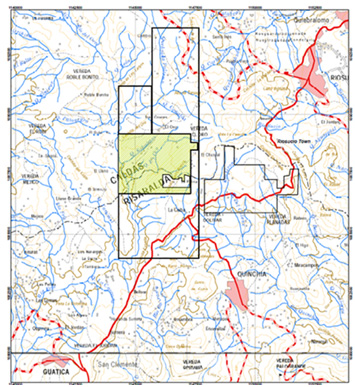

The Cerro Oro project covers approximately 2,750 hectares of which 711 hectares are controlled by a contract and the remainder through applications. The project is in the Caldas department 120 km south of Medellin.

On January 16 2013, the Company entered into a lease agreement on the Cerro Oro property (the “Cerro Oro Option”) which required payment of US$10,000 on signing and a payment of US$80,000 upon conversion of the application to a license both of which have been paid. To maintain the lease, annual escalating payments that total $625,000 over five years will be required and thereafter annual payments of US$135,000. The project is also subject to a 1.2% production royalty and a per-ounce bonus for Measured and Indicated NI 43-101 compliant Resource and Reserves.

On April 1, 2014, an exploration contract for the Cerro Oro project was issued by Agencia Nacional de Minera (“ANM”).

Funding partner agreements

On June 23, 2014, the Company entered into a share purchase agreement (“SPA”) and a shareholder agreement (“SA”) with Prism Resources Inc. (“Prism”). Pursuant to the SPA, Miranda assigned 70% of the shares of MAD V to Prism. MAD V will be the corporate vehicle that will ultimately hold the Colombian corporation that holds the Cerro Oro Option. The activities of MAD V are governed by the SA. To maintain its 70% shareholding in MAD V, effectively representing a 70% interest in the Cerro Oro Option, Prism must make an aggregate US$4,000,000 contribution to MAD V within five years. These funds will be used to fund exploration work on the Cerro Oro project.

Upon Prism funding the first US$4 million, 51 of the 70 shares of MAD V owned by Prism, shall not be subject to the forfeiture or transfer provisions of the SPA and Prism shall then have the option and right to fund through to completion of a feasibility study retain without forfeiture the additional 19 of the 70 shares.

Prism has issued 200,000 common shares of Prism to Miranda, and reimbursed Miranda for US$90,000 of lease fees that were paid by Miranda to the underlying leaseholder and reimbursed Miranda for certain expenditures incurred prior to the execution of the SA. Prism is the funding partner and Miranda is the operator in joint venture.

Location and means of access to the property

Cerro Oro covers approximately 711 hectares and lies within the Caldas department approximately 120 km south of Medellin or approximately midway between the Gran Colombia’s historic epithermal Marmato project and Batero Gold’s porphyry gold-epithermal Quinchea projects in the prolific Middle Cauca Gold Belt.

History of previous operations and previous operators on the property

Recently, informal miners have developed workings on up to 1.5m veins of quartz-adularia-pyrite that sample up to 12 g Au/t and also excavated local bladed quartz after calcite textures. Adularia and bladed texture is a common feature of the productive parts of low sulfidation gold systems and can be associated with bonanza veins. The gold system at Cerro Oro is probably low sulfidation epithermal in a similar setting as Marmato, but at a higher erosional level.

Outcrop exposure is limited to creek beds but these exposures suggest alteration and mineralization occurs over two square kilometers. Alteration seems to occur within the damage zone of a northwest-trending structural zone up to 600 meters wide. Notably it is common to recover fine free gold by panning crushed outcrop samples and artisanal miners are locally recovering free gold from in situ sap-rock by small-scale hydraulic mining. Informal miners are also recovering a significant portion of gold from veins and fractures using a simple gravity circuit without any chemicals.

Exploration work completed by Miranda and its funding partners on the property

Miranda has completed geologic mapping and extensive 2-meter channel sampling. Approximately 416 channel samples have been taken. Twenty percent of those samples assay greater than 0.2 g Au/t. Multiple sub-parallel 0.5 to two meter width veins are identified within an area of alteration greater than 1 sq. km. Locally veins, vein wall rock, and rock unrelated to veins are significantly mineralized. Veins assay as high as 2m @ 12 g Au/t and wall rock and country rock where significantly mineralized assay from 0.5 to 6.0 g Au/t. Samples unrelated to veins have widths up to 6.0 m @ 3.63 g Au/t. These widths and assays come from a database including all rock types, containing assays ranging from non-detectable to 12 g Au/t, with a median value of approximately 0.150 g Au/t.

Outcrop exposure is limited to creek beds. Where accessible in several artisanal mines, veins have been mapped and sampled. Visible fine gold is common in crushed samples of both fresh rock and saprolite - artisanal miners recover gold from in-situ weathered rocks using hydraulic methods within two large drainages on the project.

Geology and mineralization

Adularia in veins and vein-selvages, bladed replacement texture, and abundant stibnite (antimony sulfide) occurrences at Cerro Oro suggest a low-sulfidation epithermal gold system. Adularia and bladed textures are widely reported in geologic literature as being related to fluid boiling that results in high-grade gold deposition in low sulfidation epithermal veins. Stibnite commonly occurs in a zoned distribution above gold in these veins. At Cerro Oro gold-silver mineralization is hosted in sericiticly and argillically altered 2-3MA volcanic tuffs and flows of the Combia Formation associated with extensive multidirectional hematitic fractures zones. This formation overlies porphyry systems epithermal veins systems elsewhere in the Cauca Belt. Gold has a geochemical association with arsenic, mercury and antimony and generally low or background base metal values. Discreet veining is restricted at surface although inferred late-stage quartz-stibnite-gold veins occur locally. Outcrop exposure is limited to creek beds but these exposures suggest alteration and mineralization occurs over two or more square kilometers. Alteration seems controlled predominantly along a northwest-trending structural zone up to 600 meters wide. Notably it is common to recover fine-grained free gold by panning crushed outcrop samples and artisanal miners are locally recovering free gold from in situ rock by small-scale hydraulic mining. Surface exposures are intensely weathered and oxidized but one sub crop exposes mineralization that is typified by close-spaced, pyritic, generally open fractures with minor silica selvages. Miranda infers that alteration and mineralization style at Cerro Oro represents a fracture-controlled to disseminated, low-sulfidation epithermal gold system. Ore fluids have apparently flooded the porous Combia tuffs to create a bulk minable target, as well as high-grade bonanza-type veins typical of those systems. The quartz-adularia gold veins will probably develop be more robust in less porous rocks under the surface tuff. Limited reconnaissance mapping and prospecting suggests alteration is zoned from argillic to siliceous alteration with depth and that the alteration cell at Cerro Oro may have a spatial and structural relationship to porphyry-style mineralization several kilometers away.

High-grade vuggy quartz vein with pyrite and arsenopyrite from artisanal miner’s workings

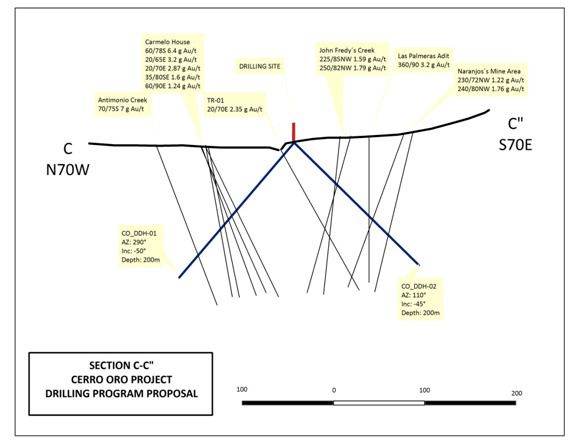

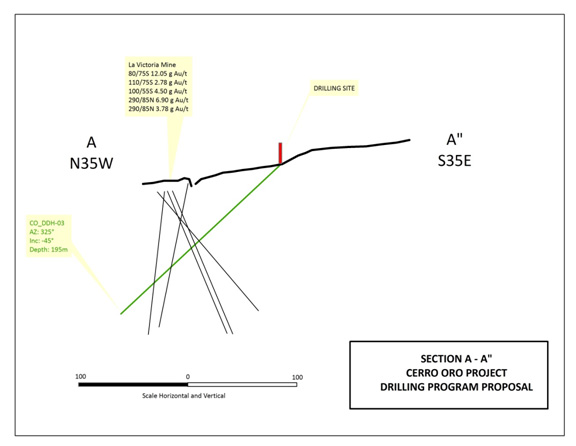

Exploration Plans

On April 27, 2016 Miranda and Prism announced a four to five hole drill program totaling 1,000 m. Drilling is anticipated to begin early of July 2016. Drilling on two profiles is designed to test several veins and intervening wall rock along a 600 m trend, where veins and country rock have the highest assay values. Both veins, and stockwork and disseminated mineralization will be tested by the same drill holes. The veins extend for approximately 2 km of strike, thus a larger drill program will be needed in the future.